Ghost Revenue and NRR: Why Your Retention Metrics Are Lying

Table of Contents

Executive Summary

- The NRR Mirage: High Net Revenue Retention rates are often artificially propped up by “Ghost Revenue”—contracted but unrealized value that inevitably churns.

- The Lagging Indicator Trap: Ghost Revenue creates a 12-to-24-month delay between customer disengagement and visible revenue contraction.

- Valuation Impact: Modern due diligence now isolates “utilization-adjusted NRR,” penalizing companies holding shelfware.

- The Only Fix: Operational rigor in identifying zombie seats and shadow discounts is required.

Ghost Revenue and NRR are the most critical metrics for any SaaS leader to understand today. Consequently, many companies believe they are thriving while a hidden crisis brews beneath the surface. Furthermore, ignoring these signs can lead to a valuation collapse during your next funding round.

Specifically, Net Revenue Retention (NRR) has displaced annual growth rate as the primary metric of company health. However, this metric is increasingly compromised by hidden inefficiencies. Additionally, investors pay premiums for NRR above 120%, viewing it as a compounding engine of inevitability.

Therefore, we must address the toxic asset class that distorts retention formulas. Essentially, Ghost Revenue represents ARR that exists in the contract but not in the reality of daily operations. Ultimately, this creates a false sense of security that destroys long-term growth.

The False North Star: Why NRR is No Longer Enough

Moreover, Ghost Revenue is the shelfware and un-activated seats that no longer map to value. When NRR is calculated using these figures, it ceases to be a metric of retention. Instead, it becomes a metric of denial for the SaaS industry standards.

The Hidden Relationship Between Ghost Revenue and NRR

To understand the destruction, we must look at the standard NRR formula. Specifically, Ghost Revenue attacks this formula from two sides simultaneously. Consequently, the results are often catastrophic for financial forecasting.

1. The Shelfware Time Bomb

Consider a chaotic enterprise deployment where a client purchases 1,000 seats but only actively uses 400. In the CRM, this account is a $1M ARR success story. However, the Ghost Revenue (the 600 unused seats) sits silently until the next audit.

Therefore, the client inevitably rightsizes the contract during the next cycle. Suddenly, $550k of ARR vanishes instantly. Consequently, this destroys NRR just as effectively as traditional churn because the contraction hits as a sudden cliff.

2. The “Bundled Expansion” Fallacy

Additionally, a common sales tactic involves bundling a new product module into a renewal at a heavy discount. Sales leadership marks this as cross-sell expansion. However, if the customer never deploys that module, you have created Ghost Revenue labeled as Expansion Revenue.

The Lagging Indicator Crisis

The most dangerous attribute of Ghost Revenue and NRR distortion is the time lag. Specifically, usage drops happen in real-time, but revenue drops happen at renewal. Furthermore, in enterprise SaaS, Ghost Revenue can hide structural churn for 12 to 36 months.

Valuation and Due Diligence: The Investor’s View

Moreover, Private Equity firms have become sophisticated hunters of Ghost Revenue. During due diligence, analysts now run “Utilization-Adjusted NRR” models. Consequently, if they see a gap between revenue and licenses, they will haircut the valuation significantly.

Strategies to Exorcise Ghost Revenue and Restore NRR Integrity

Restoring the integrity of Net Revenue Retention requires a shift from defensive account management to offensive value realization. Therefore, leaders must take immediate action to clean their data.

1. Proactive Rightsizing

It is counter-intuitive, but sometimes the best way to save NRR long-term is to force a contraction. Specifically, offer to swap unused license revenue for a different product module. Ultimately, you are trading “fake” dollars for “real” dollars.

2. Strict Definition of “Active” Customer

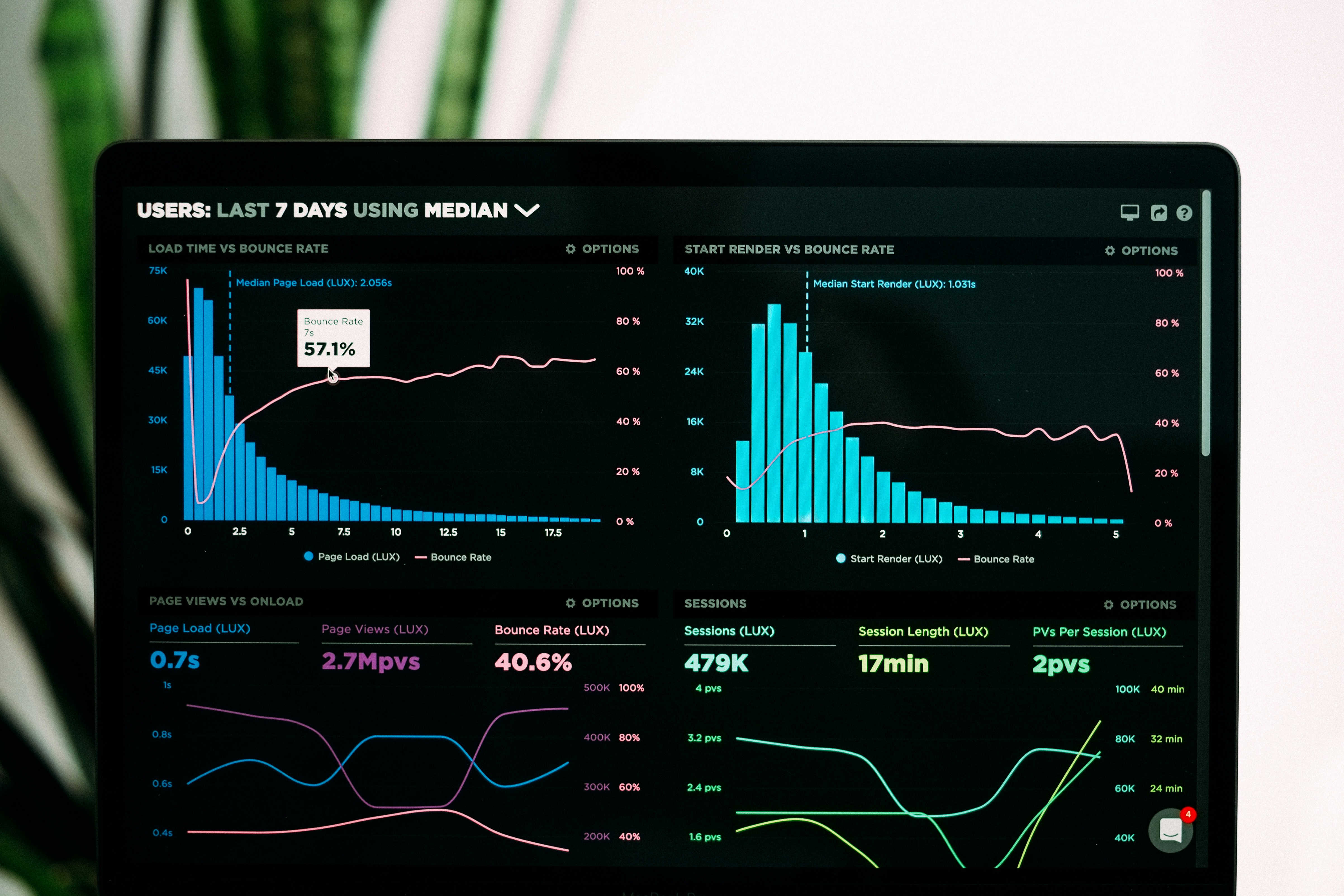

Furthermore, a customer should not be considered “retained” simply because they paid the invoice. Operations teams must build dashboards that flag accounts where the gap exceeds 20%. Additionally, this ensures your Ghost Revenue and NRR metrics remain accurate.

Is Your NRR Lying to You?

Don’t wait for the renewal cliff to discover your revenue is a ghost. Start the rigorous process of cleaning your revenue data today.

Frequently Asked Questions (FAQ)

What is Ghost Revenue in SaaS?

Ghost Revenue refers to Annual Recurring Revenue (ARR) that is contracted and paid for but not utilized by the customer, such as unused software seats.

How does Ghost Revenue affect Net Revenue Retention (NRR)?

It artificially inflates the NRR denominator while creating a high risk of future contraction, leading to a sudden drop in retention metrics.

What is Utilization-Adjusted NRR?

This is a metric used by investors that weights revenue based on actual product usage, providing a more accurate picture of long-term health.